14 Feb

For those of you who purchased,

and installed, a Woodstock Soapstone Co. wood stove in 2017 - we have good

news! The very popular residential “Home Energy Tax Credit” for Energy Star

certified improvements which had expired, was retroactively restored for 2017.

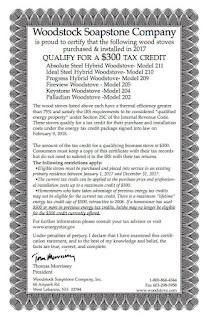

The amount of the tax credit for a

qualifying biomass stove is $300. Consumers must keep a copy of the tax certificate found on our website

with their tax records but do not need to submit it to the IRS with their tax

returns.

The following restrictions

apply:

- Eligible stoves must be purchased and placed into service in an existing primary residence between January 1, 2017 and December 31, 2017.

- The current tax credit can be applied to the purchase price and professional installation costs up to a maximum credit of $300.

- Homeowners who have taken advantage of previous energy tax credits may not be eligible for the current tax credit. There is a maximum “lifetime” energy tax credit cap of $500, retroactive to 2006. If a homeowner has used $500 or more in previous energy tax credits, he/she may no longer be eligible for the $300 credit currently offered.

|

For further information please

consult your tax advisor or visit www.energystar.gov